How To Get Right Business Loan for Your Business? Here’s a Guide for you

Business Loan: Key benefits

(1). Provide Working Capital:

To cover day-to-day operational expenses such as salaries, rent, utilities, and inventory.

(2). For Expansion & Growth:

To fund expansion initiatives, launching new product line or entering new markets.

(3). Equipment Purchase:

To finance the purchase of machinery, technology, or other necessary equipment.

(4). Business Improvements:

For renovations, upgrades, or improvements to your business premises.

(5). Inventory Financing:

To purchase or replenish stock & ensure inventory to meet customer demand.

(6). Marketing & Advertising:

To help Business reach wider audience & promote products or services effectively.

(7). Debt Consolidation:

To consolidate Debts into a single, manageable payment with a lower interest rate.

(8). Seasonal Cash Flow:

Bridge gap during slower periods, ensuring the business remains stable.

How To Find The Right Business Loan: MSM loan OR loan for startup

(1). Identify Your Needs:

Why you need the loan & how much funding is required.

(2). Research Loan Types:

Term loan, lines of credit, SBA loans. Research & understand each.

(3). Creditworthiness:

Know & assess your credit score and financial health regularly.

(4). Analyse Offers:

Compare interest rates, terms, fees, and other conditions from different lenders.

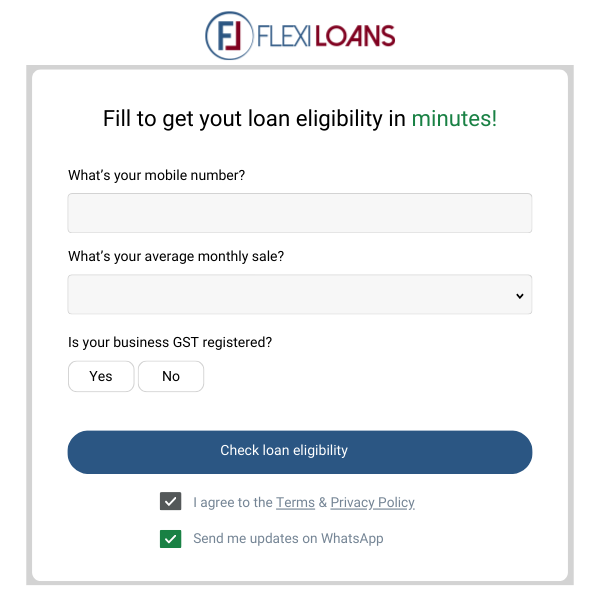

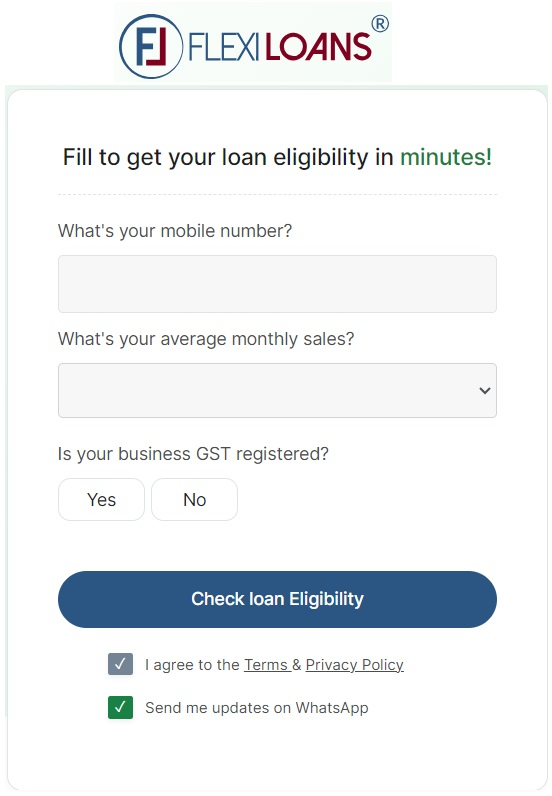

(5). Consider Online Lenders:

They offer flexibility & faster approval processes than traditional banks.

(6). Review T&C:

Check interest rates, repayment terms, fees, and any collateral requirements.

(7). Ask Questions:

Clarify all terms and conditions with the lender before proceeding.

(8). Take Review & References:

Check reviews and references for the lenders.

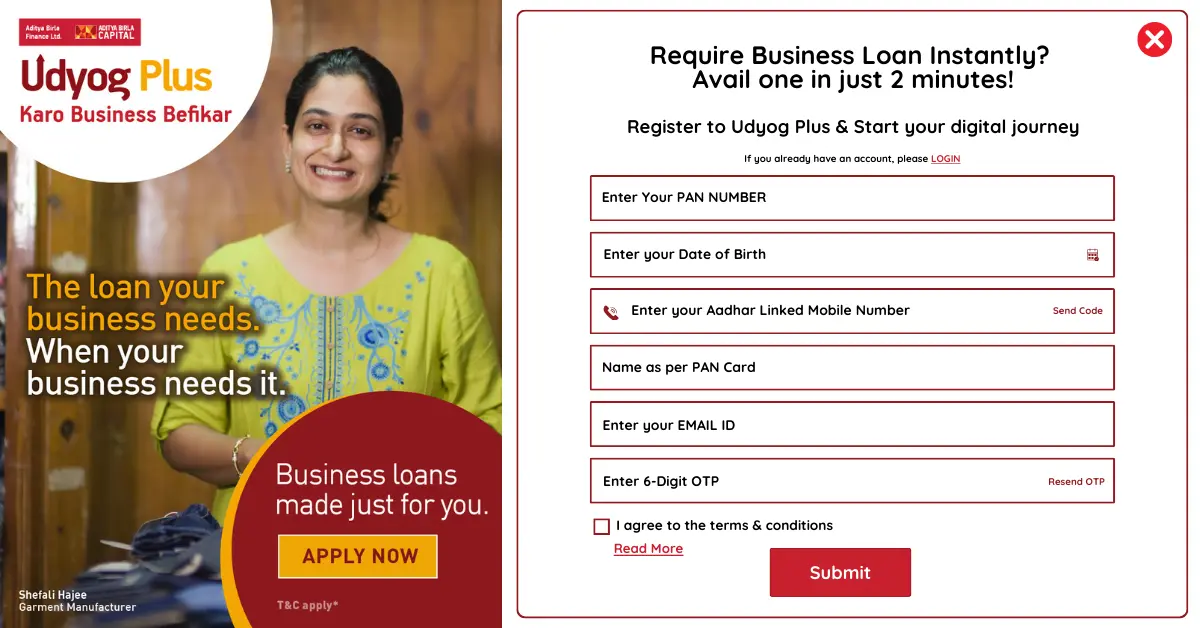

Many online lenders are offering business loans for MSME, Collateral free loan, loan for startup businesses, business loan for new business. Lending process is very fast & minimal documentation is required. Business owners just need to get their business loan eligibility checked and these loans are approved very fast. Government of India is also offering government loan for women, government loan for stand-up India, government start up loan through various different schemes. Either Personal loan or government loan or small loan, you can apply online for any.

Keeping above points in mind can help you find right business loan for your business.